Question Five of this year’s state ballot questions called for the minimum wage of tipped workers to be gradually increased over the course of five years until their wages become equal to the state minimum wage.

This law would also allow employers to create tip pools, in which all the workers’ tips would be combined and equally distributed. This question, however, was overwhelmingly rejected, with about 64.4 percent of voters, over two million people, voting against it. The result of this ballot question was not just politically disappointing; it was a direct failure to provide for all service workers, including students at Boston Latin School, with the stability and support that they need to thrive in today’s economy.

Question Five would have tremendously changed the way tip workers are paid in Massachusetts. Their current minimum wage of 6.75 dollars would have increased gradually to the state minimum wage of 15 dollars by 2029. Large companies especially must be held accountable for paying their workers fairly without having to rely on customers to tip. Employers should be responsible for paying their workers enough without their employees often having to work other jobs to make a living.

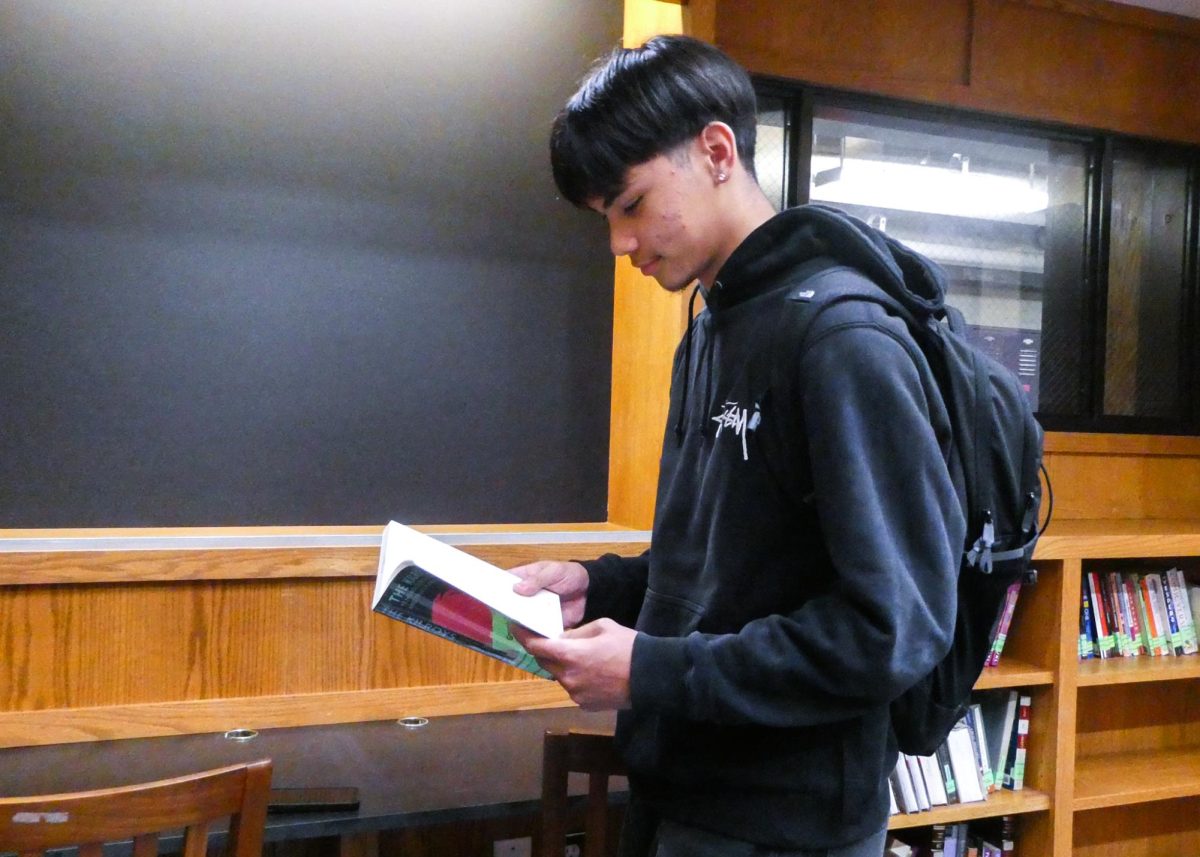

As inflation and the cost of living grows while the minimum payment for tipped workers remains the same, it becomes increasingly difficult for them to maintain livable conditions. Nam Truong (IV) notes, “Working as a high school student for wages to be this low forces me to work more and causes extra unnecessary stress.”

Workers must rely on tips, which are not always very high, or at times even nothing, since tipping is not required of the customer. It is also not fair that employers are able to pocket more money while employees struggle to get by.

Tip pooling was one of the most controversial and misunderstood aspects of this proposal. Many voters were concerned about the fairness of tips; some thought that pooling tips would ensure fairness, while others disagreed, arguing that tips should go to whoever earned them.

Kate Lincecum (II) explains, “At the end of the day, in many jobs, you don’t pick your shifts; they are assigned to you. So if someone happens to get a shift with bad weather, or [one that is] just slow, they will get less tips, even if they worked for the same amount of time.” The tips workers receive do not always depend on their performance, but other external variables.

Tips, however, should not be pooled. The creation of tip pools may allow workers to start relying on other employees to receive higher tips, as they would ultimately still receive the same amount as them. Many people misunderstand this attribute of the ballot question, believing that tip pools would be mandatory at every location where workers are tipped, when in reality the passage of this amendment would give employers the option of facilitating tip sharing.

Another major concern about Question Five was retaliation from employers who feared losing money. BLS AP Economics teacher Ms. Ashley Balbian states, “Many employers spoke out against Question Five, threatening layoffs, closing restaurants and increased prices.” Had these threats come to fruition, they would have negatively impacted the economy, with jobs lost, businesses closed and restaurant prices inflated. The minimum wage, however, would have been only raised in increments year by year. If employers didn’t take action to protect their business and their own financial affairs, the impact would likely only have been marginal.

Question Five was ultimately not passed, but the debate and conversations that it sparked on the need to better protect and support minimum wage workers must continue to be held. The proposal’s rejection should not be seen as the end of this discussion, but rather the beginning of an attempt to fix Massachusetts’s relationship with minimum wage workers through policies.

Categories:

Tip Your Hat to Service Workers: Pay Them More!

By Elaine Lin (IV), Contributing Writer

November 30, 2024

0